I’m not going to hide that I am a huge fan of a decentralized currency that can be used to purchase goods across cross borders without a middleman haggling me. There are over one thousand cryptocurrencies in existence right now and if you haven’t yet invested in one, I recommend reading this article to discover if cryptocurrencies are right for you. Cryptocurrencies are risky, risky for consumers and risky for businesses alike but in my opinion, the benefits outweigh the risks. (Take that with a grain of salt because I also like to jump off cliffs).

I’m not the only crazy one though. Kim Lachance Shandrow from Entrepreneur wrote about the 80k businesses that are already accepting Bitcoin, so what’s stopping you?

Here are the top 8 reasons why you should start accepting Bitcoin as a form of payment on your eCommerce site now:

1. Bitcoin Opens You up to New Customers

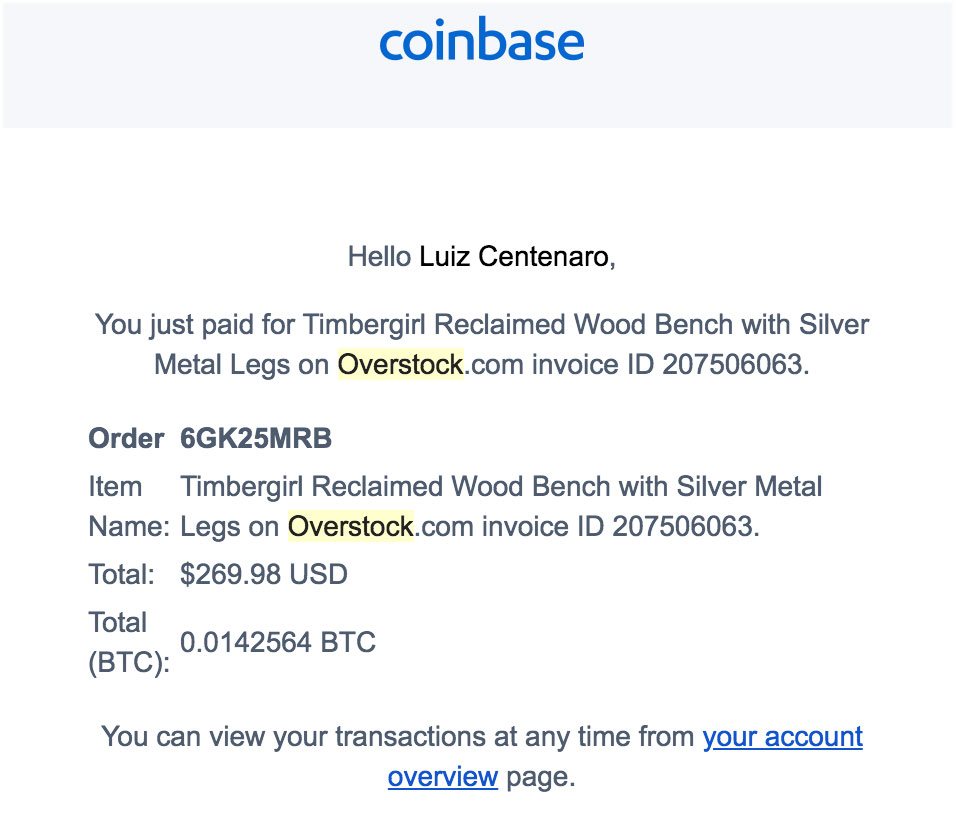

If you don’t believe this, well you should. When I was shopping for furniture, I decided to buy from Overstock.com because they accepted Bitcoin.

I’ve never shopped on Overstock before and would have 100% shopped elsewhere but I wanted to test out shopping with Bitcoin. It was a fantastic experience buying through the trusted blockchain ledger. Most of my crypto friends made fun of me, telling me to hold the currency instead of spending it.

Patrick Byrne the CEO of Overstock is a huge proponent of blockchain technology.

Byrne wants to undermine Wall Street with the tech behind Bitcoin, and Overstock became the first major company to accept bitcoin in 2014. Byrne describes blockchain as a magical ledger, it can’t be erased and it’s protected cryptographically while generating trust between strangers.

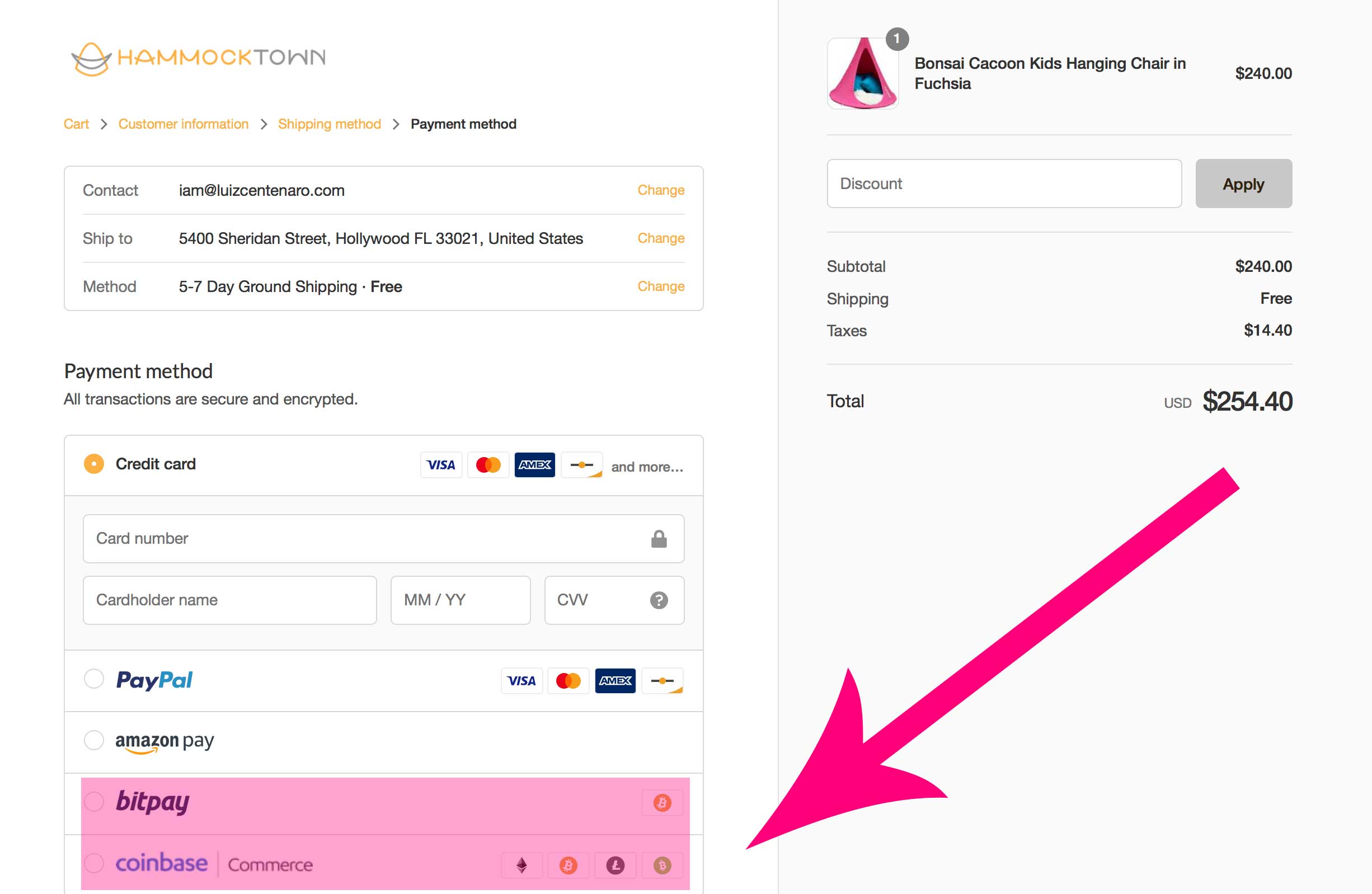

Within Shopify & Shopify Plus you can easily set up your checkout to accept payments with cryptocurrency. Here we are showing the examples of Bitpay and Coinbase.

Bitcoin is increasing the choices of payments for eCommerce customers. Businesses are going to great lengths to differentiate themselves by offering a customized experience unique to the business. One great way to offer this customized experience is by letting your clients select the method of payment. This broad variety of payments brings new customers to the business who would not have done business with your company if you lacked bitcoin as a payment method.

2. Accepting Bitcoin makes your eCommerce Store Innovative

Allowing customers to choose different payment options such as Amazon Pay, Apple Pay, and Google Pay make your store hip, now imagine how cool you’ll be among the millennial generation if you accept cryptocurrencies such as Bitcoin as well. Don’t freak out, 99.99% of Bitcoin users are going to hoard the currency and it will be less than 0.0005% of your store sales, but it will still make you look cool. Isn’t that why you started your eCommerce store in the first place?

One of my favorite stores is BitGiftShop.com not only do they accept bitcoin they sell Bitcoin Art! From canvases to t-shirts, to purses. You’ll find unique gifts for bitcoin enthusiasts on this store.

3. Bitcoin is a Long-Term Investment with Low Inflation Risk

Some companies exchange their Bitcoin into USD automatically but I prefer to hold it as a long-term investment. Bitcoin offers zero risk of inflation. During inflation, the government provides more money throughout the year, reducing the buying power of its citizens. However, bitcoin was made to be finite, only 21 million Bitcoins will ever exist and there are about 4.3 million left to be mined. Hence, there is no possibility of providing excess currency, making inflation risk zero. Both the buyer and the seller enjoy this benefit. This is especially true during these volatile times with the USA and China in a trade war.

4. Low Transaction Fees

Shopify takes a fat percentage of your sale, your merchant services account will take a fat percentage, the only people taking a cut out of your bitcoin are the bitcoin miners.

Credit card expenses typically run about 2-3% that can consume a lot of business profit particularly for businesses with low margins. Businesses that use bitcoin can incur lower fees of below 1% and do not require a high volume of transactions required for leverage with credit card firms. These low fees involve the conversion of money into local currency. But if money is retained in bitcoins, there are no expenses.

As a business grows, you can negotiate lower credit card costs from current credit card firms. But this lower costs are just a fraction of a percent and will make little difference as compared to bitcoins which incur no fees when retained in their currency. Bitcoin allows for an individual to merchant or peer to peer transactions at a small scale. This makes micropayments a lot more viable than they have ever been. Consequently, completion of transactions can be done at less than half the expense.

For instance, if your business makes $2 million in revenue annually, your credit card firm will charge you $40,000 which is 2%. Switching to Bitpay or Coinbase will save you half the cost since 1% will be $20,000

5. Fraud prevention

When buyers are making payments on your eCommerce site, they do not require offering any critical financial information. Such information includes debit or credit card details. Hence, customers will enjoy financial anonymity to a particular degree, which the majority of the credit companies fail to provide. Bitcoin is a digital currency that is beyond the hacker’s reach. Your money is not only protected but your identity too. Hence, data breaches such as the UPS Store breach are curbed.

6. Receive Funds Quicker

When accepting payments made via debit or credit cards, it can take a couple of days before receiving funds for goods or services sold. This issue comes about as result of third parties that are involved in payment processing that is traditional; each payment has to be verified by the issuer of the buyer’s card and the vendor’s bank. Since bitcoin transactions are verified by a network of miners, they are very fast as compared to bank transactions. Hence, you can receive payments in minutes.

7. Accept International Payments

If your firm has been avoiding acceptance of international payments because of costly cross-border fees of transactions, accepting Bitcoin as a method of payment offers a solution to your problem. Even though going international is good for business, many eCommerce businesses can’t participate on the global stage due to high fees they cannot afford. However, Bitcoin solves this challenge with low fees of a transaction which allows your business to trade globally and accept payments from all customers all over the world, at a button’s click.

8. Bitcoin is Easy To Use

Bitcoin is extremely easy to use. People think Bitcoin is hard to use because they fail to comprehend it fully. To avoid adverse impacts to your business put some effort to learn bitcoin. If you want, you can dive deep into understanding the technical aspects like the working of the blockchain and cryptographic hashing, but it is unnecessary.

Coinbase is already making it easy for you to accept and use bitcoin. Coinbase and Shopify allow 1 click cryptocurrency integrations. You can add it as quickly as you add Visa or Paypal. Coinbase is also easy to integrate and provides solid customization options. Moreover, merchants are not charged on the first $1M in transactions.

Great so why isn’t everybody and their mom accepting cryptocurrency? There are many drawbacks to accepting Bitcoin payments.

Here are some of the drawback to accepting cryptocurrency payments on your eCommerce store:

- Black Market Money

During its inception, Bitcoin was linked to the dark web. During that time, the currency was popular for funding illegal businesses like human trafficking, and weapons. Those who don’t know much about it still see the association between the currency and illegal market. Although it is currently used for legal businesses, there are still some illegal markets that use it. Some customers might migrate to the competition when they realize that you are associated with Bitcoin.

- Exposure to Bitcoin Specific Fraud

As the most popular currency in the world, bitcoin has experienced various attacks, fraud, and scams. These include small-scale Ponzi schemes like Bitcoin Savings & Trust and large-scale attacks like the breaches that led to the fall of Mt. Gox and Sheep Marketplace. Other cryptocurrencies lack critical user mass to make such illegal profits for criminals. If traditional currencies were involved, such acts would be prosecuted under the law.

- No buyer Protection

When buyers use bitcoin to buy services or goods, and the seller fails to deliver, the transaction cannot be reversed. Resolution for such a problem can be made via escrow service that are third-party such as ClearCoin. However, escrow services could take the roles of banks, causing bitcoin to resemble traditional currencies.

- No Valuation Guarantee

Due to a lack of central authority that governs bitcoin, there is no guarantee of a minimum valuation. If a big merchant group resolves to dump the currency and exit the system, its value will drop substantially and consequently impact the users who have invested a lot of their money in bitcoins. The fact that the currency is decentralized is both a pro and a con.

Conclusion:

So to the person who asked if they should accept Bitcoin payments for their fashion startup. My answer is yes. The benefits outweigh the risks. Evolve or die.

What do you think? Will you start accepting Bitcoin?