I bet you didn’t start your eCommerce store so you could collect sales tax for government agencies.

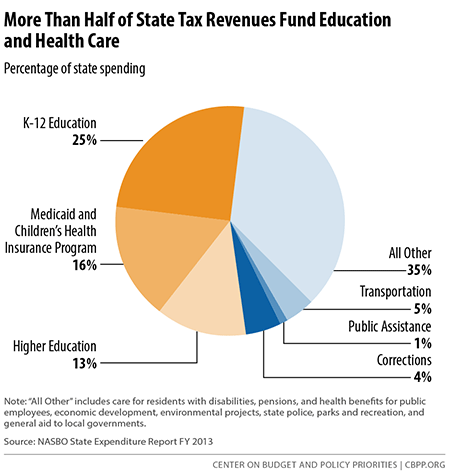

Sure you’re a good samaritan, you enjoy helping the government collect funds for schools, roads, and all the wonderful things states invest in.

Most of our sales tax dollars go to good causes. Education + Healthcare.

Source CBPP.org

But I know for a fact you didn’t get into the eCommerce business to collect sales tax. Heck it was probably the last thing on your mind and when you heard the word Sales Tax Nexus you almost fainted.

I got into eCommerce because it’s the future. You click a button and the wheels start spinning, the cogs align and within a couple days a package arrives at your door.

I built Hammock Town because I am passionate about the outdoors, I believe people need to relax more and be grateful for what they have and I wanted to build a business that would allow me to travel, a business that I could run from anywhere in the world with a wifi connection.

The innovation in eCommerce continues to amaze me. Merchants all over the world are crafting incredible shopping experiences, experimenting with virtual reality and delivering significant value to consumers.

But you cant’ build something incredible without paying Uncle Sam. You could get sued by the state, and even go to jail if you fail to abide by the constantly changing tax laws.

As an eCommerce store owner you aren’t really “paying” taxes, you are acting as the state’s tax collector. Collecting sales tax on orders that require it and paying that to the government monthly, quarterly or yearly depending on the laws of your state(s).

Like most eCommerce store owners I know, I have not perfected the complex sales tax system and have done many things wrong running Hammock Town. Before discovering TaxJar, I used to purposely exclude my nexus “Florida” from advertising in Google PPC and Facebook Ads.

So if you have a question about sales tax, there is one answer that fits every single question you may have.

It depends.

I am Brazilian born and have lived and traveled to many countries but America in my opinion is the best country in the world. It’s my favorite because each state is a mini country, every state has a unique culture, laws and traditions mostly thanks to the U.S Constitutional Amendments, particularly Amendment #10.

“The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

The government has given the states the flexibility to take laws into their own hands (which I love!) but it’s created an eCommerce sales tax nightmare. 100 years ago people weren’t buying from one state and shipping to another like we are today.

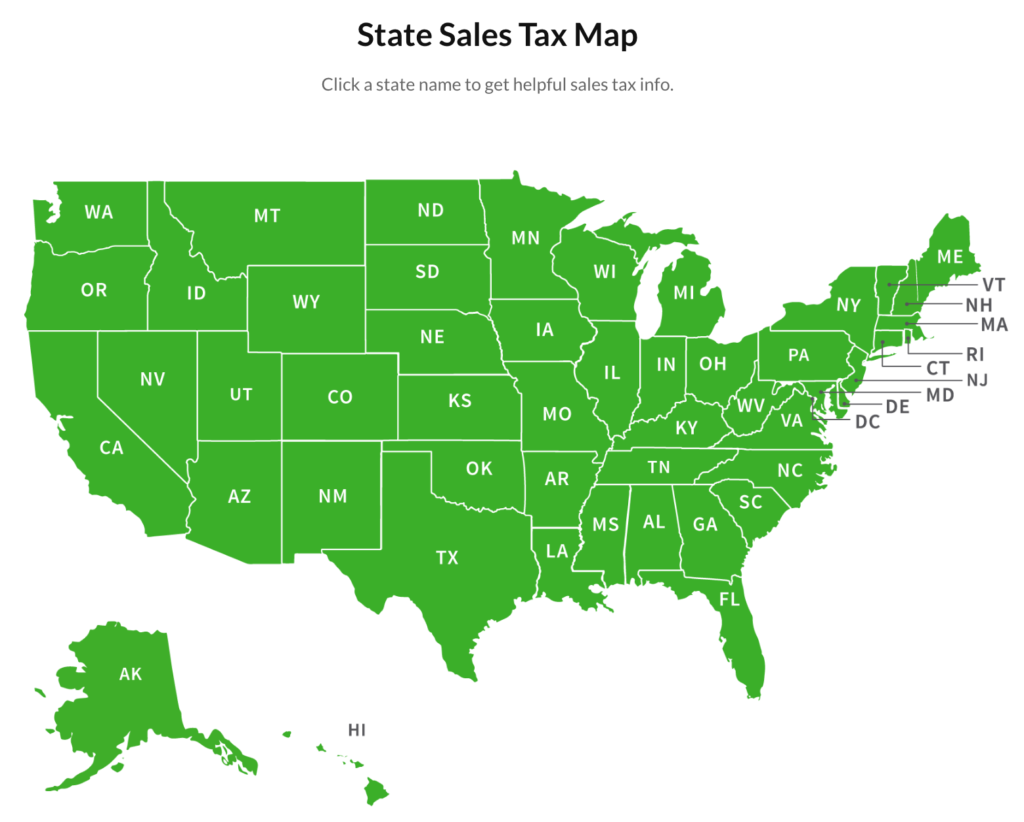

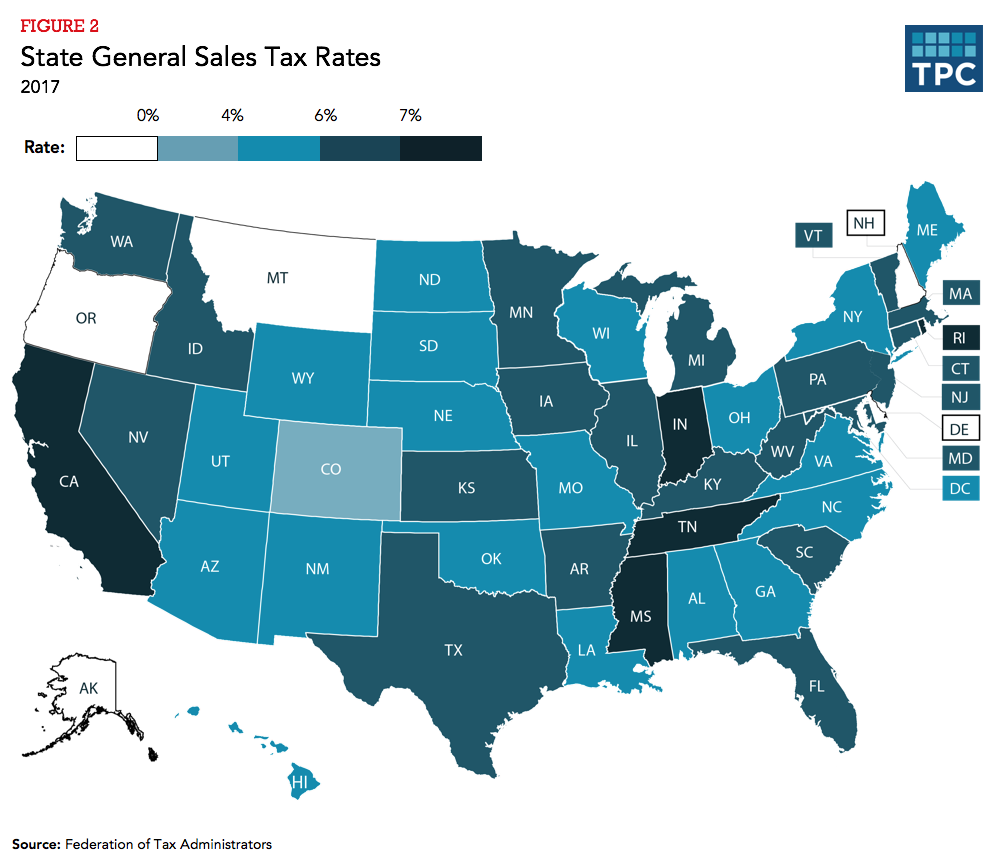

Now there are 45 states + D.C that levy a sales tax, and every single one of them has a different rule you need to abide by. (which I hate!)

Source: Tax Policy Center

Some states charge sales tax on shipping, others require you to renew your tax permit, and to make matters extremely fun in States such as Alaska there are no statewide sales tax but there are local areas that charge sales tax!

Most states require that you file a sales tax report even if you do not owe sales tax. If you do not file, you could be subject to penalties. Pay close attention to instructions you receive your sales tax permit.

It was a fun surprise $500 dollar surprise to find out I had been sent to collections for failing to file a tax return when I didn’t collect any sales tax that quarter. I’m waiting on a 30+ minute long hold with the Florida Department of Revenue as a I write this post.

I found out this the hard way while and had to pay over $500 to collections when I didn’t owe anything to begin with because I didn’t collect any sales taxes that quarter.

It’s an eCommerce nightmare really. Luckily there is an abundance of information out there to help you navigate the wonderful world ? of eCommerce taxes. The folks at TaxJar created a rad eCommerce State Sales Tax Map to help you figure out the laws you need to abide by.

Unluckily, keeping up with eCommerce tax regulations, is a full time job and you already have 10 of those if you are running an eCommerce store.

Ok So Where and When Do I Have to Collect eCommerce Sales Taxes?

Online retailers must collect sales tax in states and cities in which they have a “sales tax nexus”

Where do you have a sales tax nexus? Well… that depends. The 3 most common examples of sales tax nexus in include Home state nexus, employee nexus and inventory nexus.

1. Home state nexus: You registered your eCommerce business in Florida. Because you have a physical presence and address in Florida, you have “sales tax nexus” there meaning you are required to collect sales tax from customers in the state of Florida.

2. Employee nexus: You live and run your eCommerce business in the state of Florida, but you hire an intern in LA to help you. Because you operate out of Florida and have an intern in LA, you now have sales tax nexus in Florida and California and must collect sales tax from buyers in both states.

3. Inventory nexus: If you store your inventory in a warehouse in a state, then that constitutes sales tax nexus. So if you live in Florida, but store your inventory in Idaho for the purposes of faster shipping, then you have sales tax nexus in Florida and Idaho.

You may think this doesn’t apply to you but thinking that is a surefire way to get a sales tax audit conducted.

For every state you have a Sales Tax Nexus in you are going to need to register for a sales tax permit.

The fine folks at TaxJar wrote guides with detailed instructions for every single state! If your state isn’t listed below than you live in a state with no sales tax! (You lucky dog ?)

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington DC

- West Virginia

- Wisconsin

- Wyoming

How to Collect Sales Taxes from Your eCommerce Buyers:

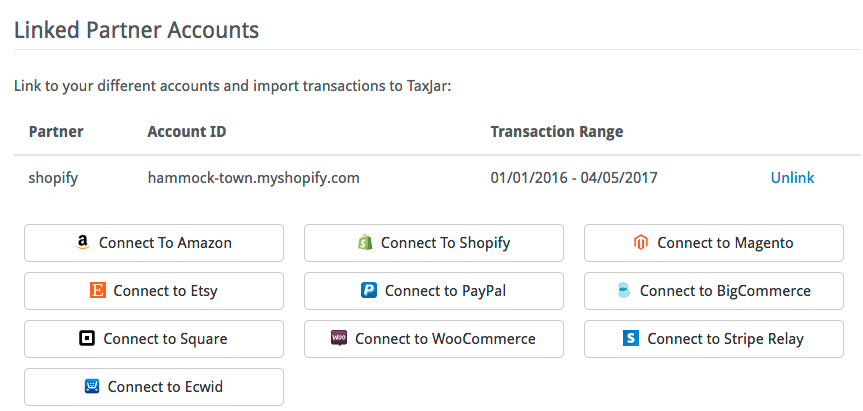

Most eCommerce channels will help you automatically collect sales tax. My favorite eCommerce CMS Shopify makes this process super simple.

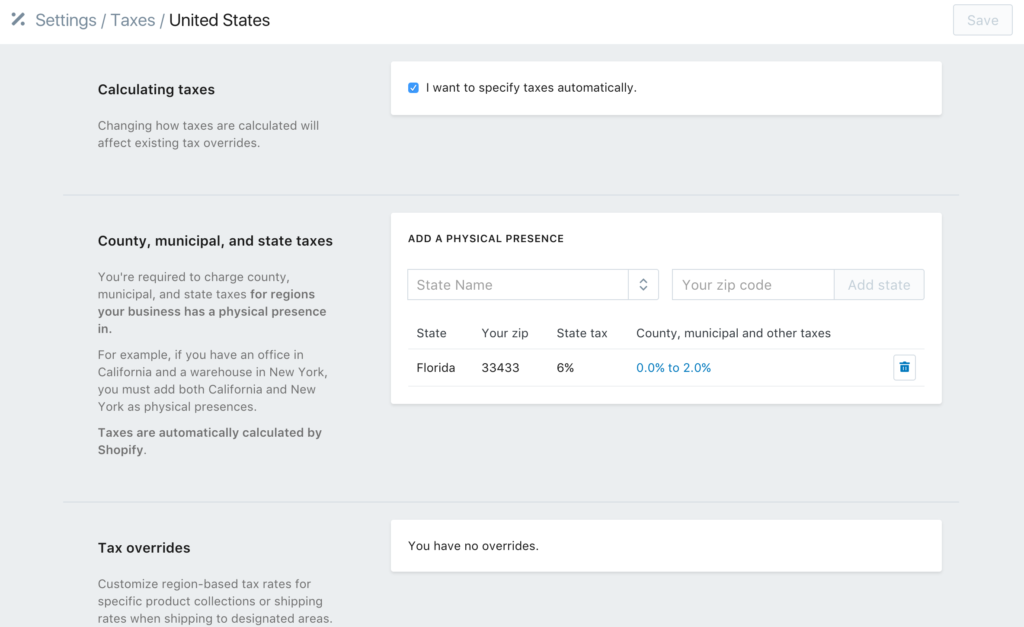

When you are developing your online store you can specify sales tax rates depending on where you have established nexus.

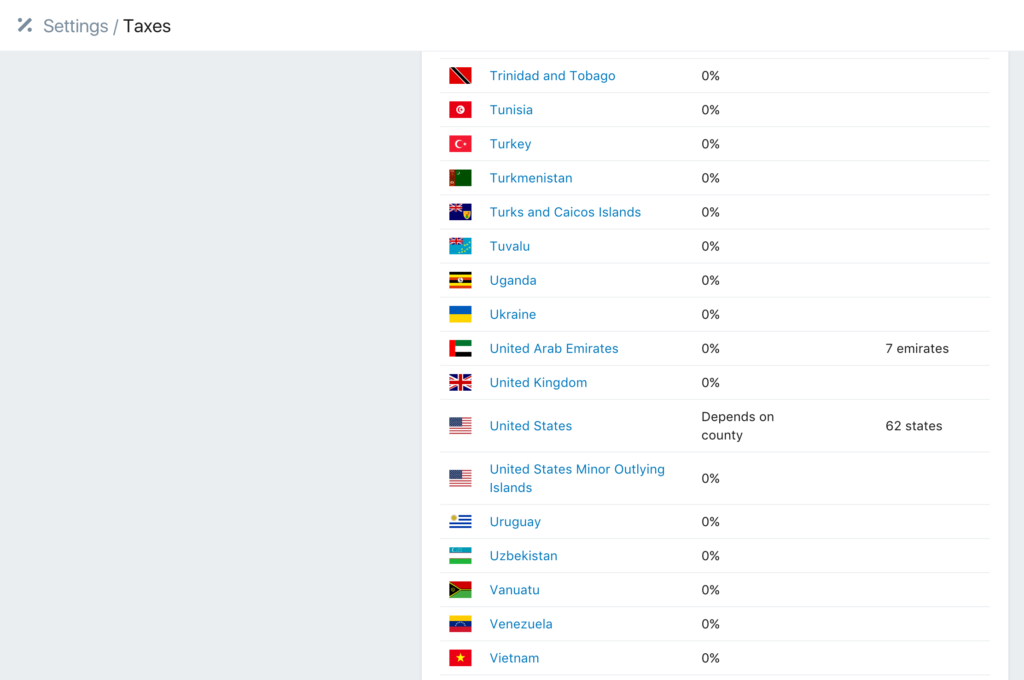

To do so you simply login to your settings than navigate to Taxes.

If you are in the United States you’ll click “United States” then add your zip code to establish your physical presence.

Once that is all setup your Shopify store, will start to automatically collect sales taxes for you.

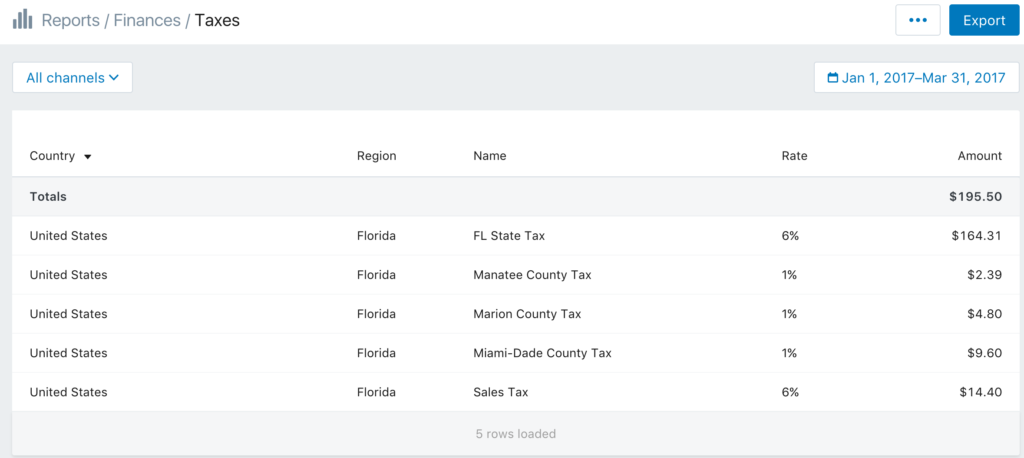

So that part is pretty easy! The not so easy/fun part is filing these every freakin’ quarter. Remember in some states like Florida, you have to file even if you don’t collect sales taxes from customers that quarter.

Filing your sales taxes with your state isn’t rocket science. It’s just not how I want to spend several hours each quarter.

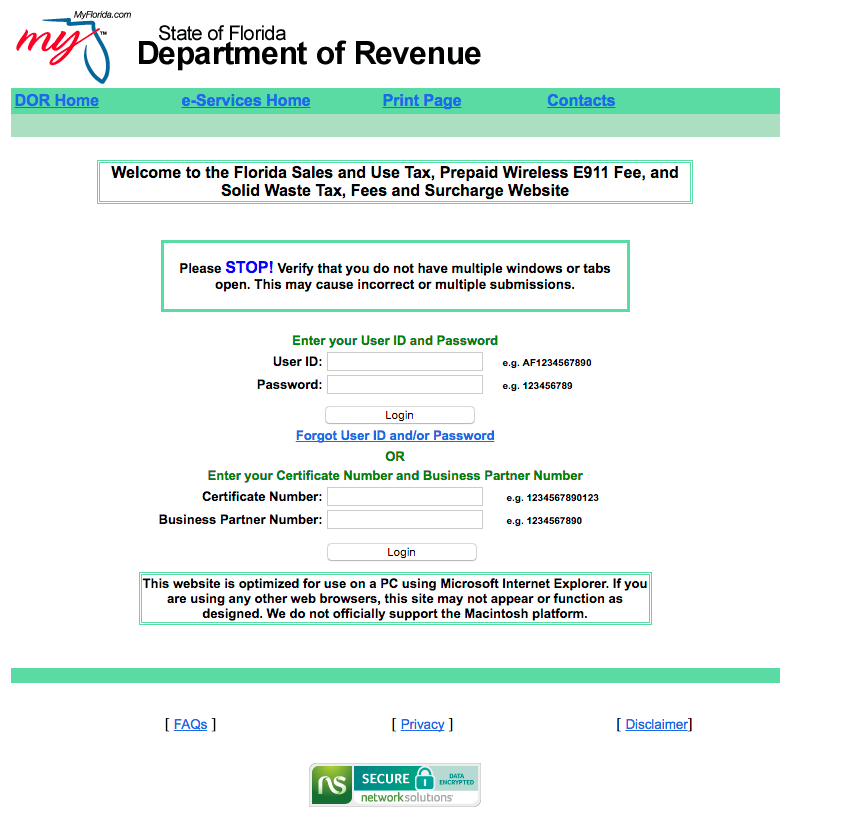

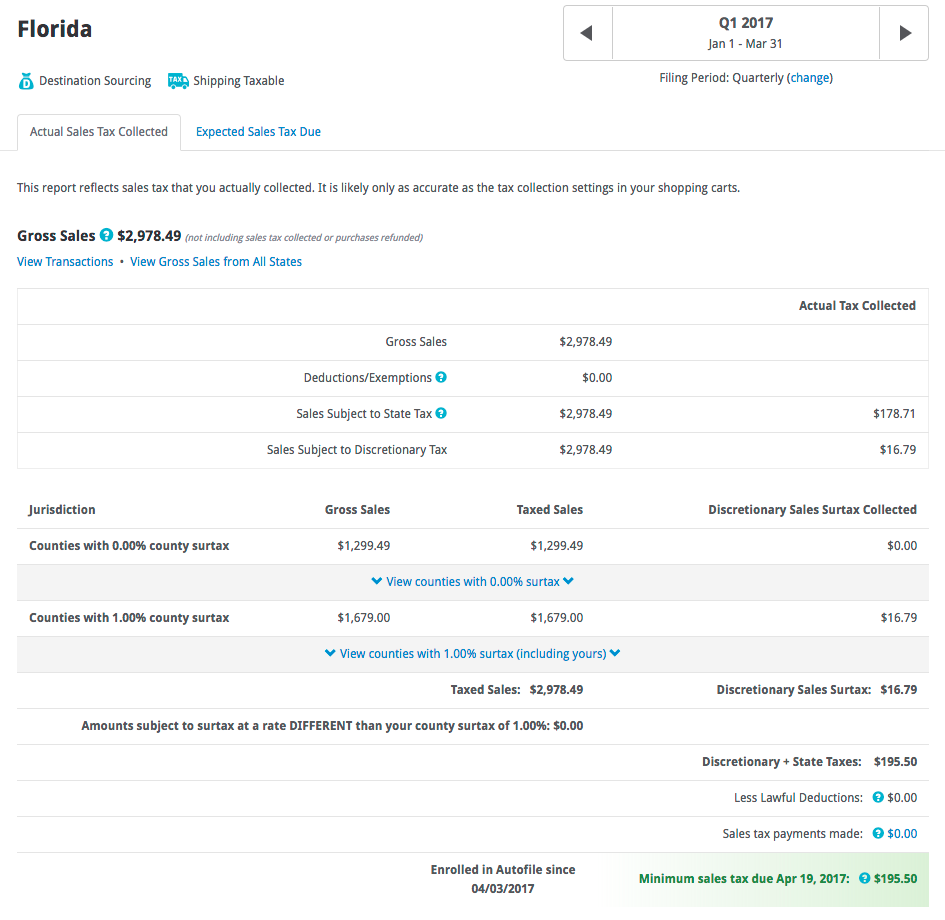

If you choose to do it yourself I can walk you through Florida’s process. Since I run a drop shipping business I only have a Sales Tax Nexus in Florida. I don’t have fulfillment centers, I don’t have employees, I don’t have affiliates nor do I use Amazon FBA so I only have to worry about Florida. I can’t being to fathom doing this manually for 12+ states. I’d leave the eCommerce world immediately.

Instructions for Filing Sales Taxes in Florida:

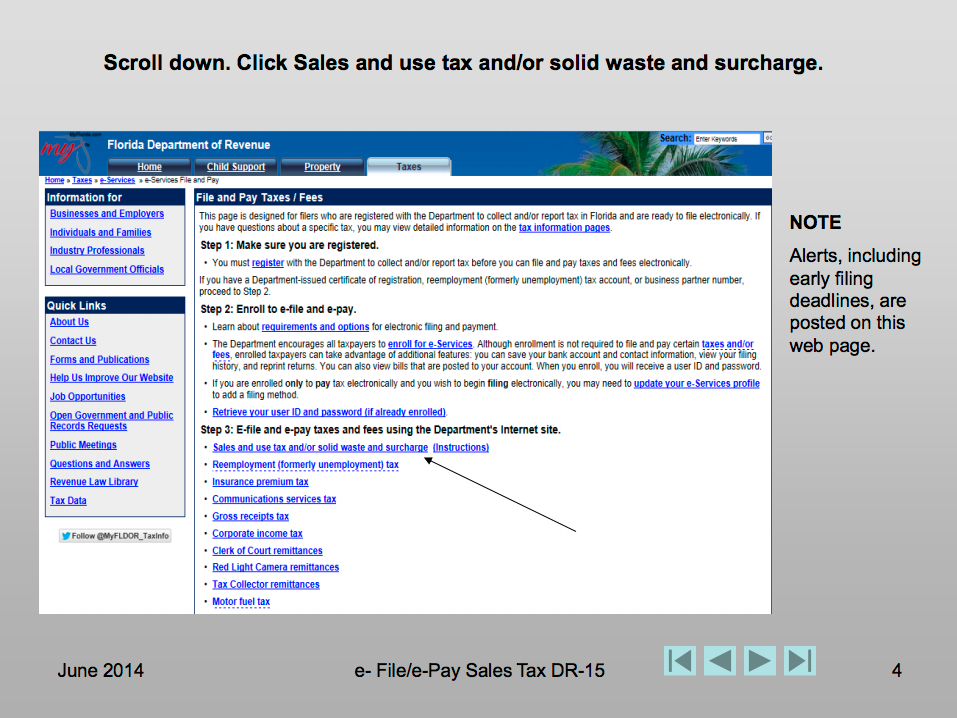

Step 1: Login to the State of Florida Department of Revenue

Step 2: Follow this 41 page PDF with instructions on how to e-File and e-Pay Sales Tax – DR-15 in Florida created by the state of Florida. ?

Step 3: Don’t do any of that, be wiser than I was my first 2 years running Hammock Town and automate the process. It’s well worth $308 a year, I got fined nearly double that for missing a date where I had to file $0 in sales taxes. GRRR.

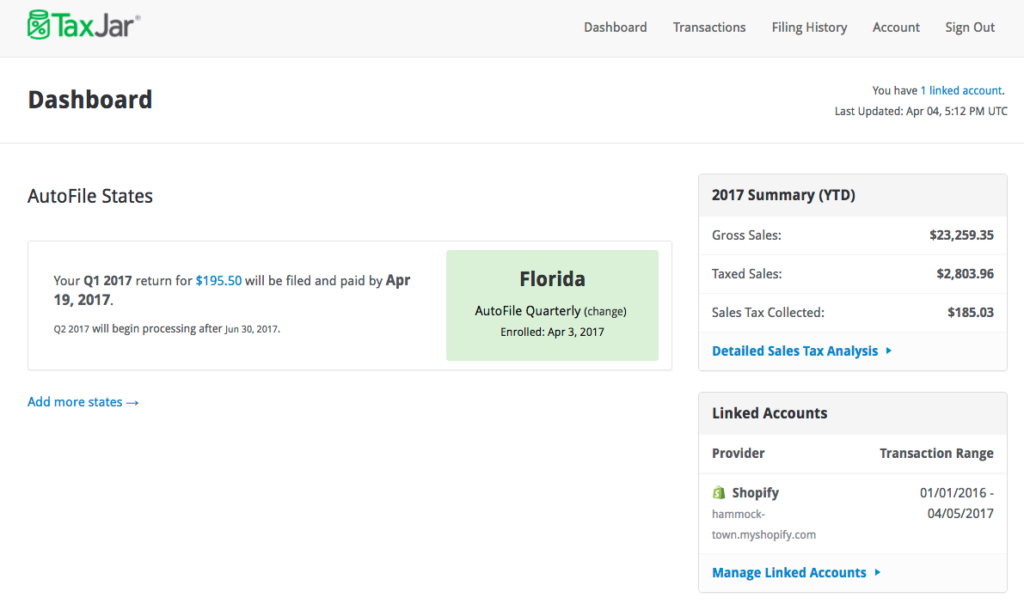

I now automate the Sales Tax process with TaxJar.

I freakin’ LOVE you @TaxJar. Calling all #eCommerce merchants, you no longer have to manually file your #SalesTax let #TaxJar do it auto pic.twitter.com/NnNHpnTLYb

— Luiz Centenaro ? (@LuizCent) April 3, 2017